Why winning crypto platforms are choosing fiat-as-a-service

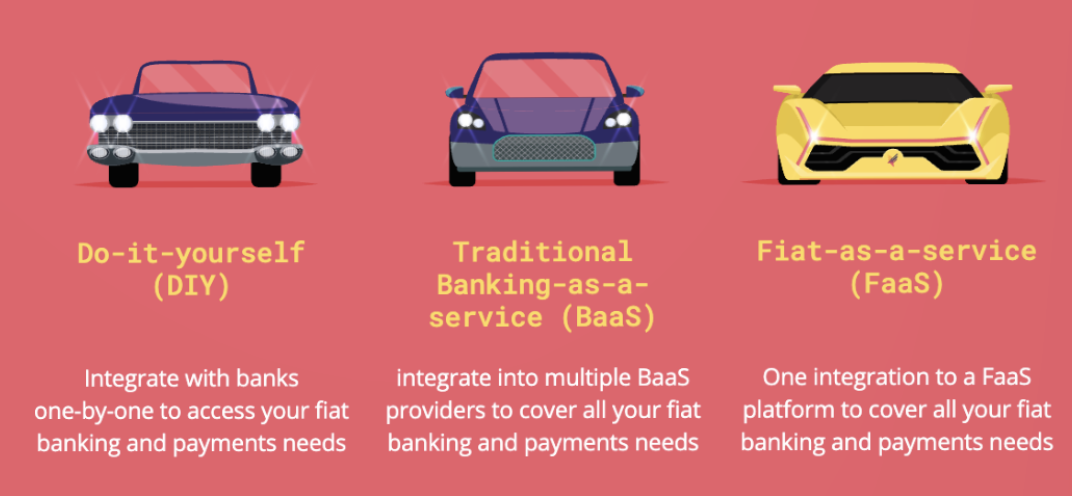

How to select your fiat strategy race car for winning the banking integration race. When selecting your race car, you should consider its 0-60 acceleration for a fast go-to-market launch and its top speed for expanding to new markets. How? First, you need to evaluate the options you have available:

DIY: integrates with banks piece-by-piece, with each update requiring a fresh reset

BaaS: The engine is not built for the crypto industry, so it must be modified: crypto architecture can only be bolted on, and each update requires additional changes. Underlying banking partners are not always crypto-friendly, leading to potential abrupt debanking

FaaS: A Faas engine is tuned exclusively for crypto platforms, all underlying banking partners are crypto-friendly, and all product updates are seamless

Your 0-60 Test: poor APIs lead to slow performance

Imagine you need to launch quickly, but your fiat providers’ APIs are inconsistent, complicated, and perform slowly. This gets in the way of your tech team’s ability to build quickly and with freedom. They must constantly go back to the fiat provider’s tech team for support. Add on to this poorly written technical documentation that causes further obstacles and delays to your launch.

According to Kaloyan Yanchev, Head of Payment Methods at Nexo, speed of integration is essential, and you, therefore, need to ask yourself, “how good are the APIs? How easy is it to integrate into our ecosystem? Is the technical documentation well written and easy to follow?”

Your top speed test: Avoid the payments drag

Launching and expanding to new markets requires you to have the ability to provide end-user accounts in their local currency, using local virtual IBANs and transactions processed on local instant payment rails (FPS, SEPA Instant, ACH Instant). If you don’t have this setup, you can expect a drag on your top speed and can only watch as other crypto platforms whizz by, who are delivering local currencies with instant payments for users.

There’s only one car you want, whether you’re launching or expanding:

– the most seamlessly integrated

– reliable access to banking and local payments rails

– radically simplifies payments operations

– empowers you to deliver a frictionless fiat on-ramp and off-ramp for your users

Selecting your Fiat Strategy race car is a team decision

Understanding how your fiat strategy impacts your product, technology, operations, commercial, finance, and payments teams is critical.

The car you have selected impacts every business function. Here’s an overview:

Commercial

DIY:

– High integration costs due to multiple complex integrations with banks

– Long times mean delays in delivering new currencies and payments to users

BaaS:

– Multiple integrations might be required to get the fiat coverage required

– You must ensure the partner works with crypto-friendly banks across desired geographies

– A certain level of partner education is required regarding crypto flows

FaaS:

– A single integration for access to multiple local rails worldwide

– Assurance that: they partner with crypto-friendly banks and understand crypto flows and businesses

Payments operations and treasury

DIY:

– Need to log into multiple banking interfaces and upload files, review payments, and interact with multiple teams

– Ops and RFI Processes for each bank will likely be different

BaaS:

– Still need to log into multiple BaaS interfaces to a certain extent

– Ops and RFI Processes for each provider will likely be different

FaaS:

– Log into a single interface to handle all payments

– Early visibility of payments, even when they are in a compliance review

– One-click refund when receiving incorrect payments

– A single interface for all communications with the payments team of the partner (rather than chaotic emails, etc.)

Product

DIY:

– Little space in the roadmap, several complicated integrations to plan and maintain annually

BaaS:

– A couple of integrations to plan a year to add new BaaS partners supporting local accesses where you would like to launch

FaaS:

– A single integration to a very modern infrastructure covering all your fiat needs

Compliance

DIY:

– Answering multiple RFIs from many different banks

– Working with banks that don’t understand crypto flows

– Trying to keep up with different compliance requirements of each bank on an ongoing basis

BaaS:

– Answering multiple RFIs from several BaaS providers

– Working with BaaS providers that don’t understand crypto flows

FaaS:

– A single interface for all communications with the compliance team of the partner (rather than chaotic emails, etc.)

– Leveraging the modern infrastructure of the partner when it comes to AML and transaction monitoring to reduce fraud levels

– Benefiting from insights generated by analyzing data across multiple crypto platforms and the possibility of identifying bad actors using several crypto platforms

Technology

DIY:

– Difficult integrations with legacy systems of traditional banks

BaaS:

– Several integrations to carry out with relatively modern infrastructures

FaaS:

– A single integration with a very modern infrastructure means better security and scalability, better placed to handle large volumes

Roadmap: How you handle updates

DIY:

– Complete reintegration for every update

BaaS:

– Every update is haphazardly bolted on

FaaS:

– Like updating your phones! All future product developments come right on through

Staying in the race: Internal and external reliability

You’ve considered how each banking integration type might support a quick launch or seamless expansion. But have you considered how the type of integration inevitably affects the reliability of your banking relationships? After all, choosing the fastest car isn’t just about putting your foot forward on the 0-60: it’s about keeping it there to get and maintain top speed.

Operational reliability

So, ask yourself: Will your fiat car be prone to constantly going off the track? It’s a more complex question than at first glance since you cannot only consider the integration in isolation. Instead, it would help if you thought of how the fiat platform performs in your daily operations: think of suspended payments, debanking, or managing payments reconciliation. These all prevent you from keeping your foot down and focusing on delivering value for your users.

Reliable bank relationships

Trusted relationships with banks are essential to keep your crypto platform in the fiat strategy car race. Just as you want a car that allows your team to be agile, you want a reporting system that banks can trust to drive on their rails. Think of the bank’s perspective as a pre-race health check. In this case, even if the car is perfect, banks want proof that the driver (your platform) can ride each time and has a driving license. It’s crucial; therefore, you can provide evidence of your KYC and AML processes: you need to give the bank visibility of both off-chain and on-chain money flows. Manually doing this requires slowing down whenever you receive an RFI request. Alternatively, imagine your car provides this data and information to the bank while racing. In that case, you can ensure you don’t have to slow down whenever you receive an RFI request.

Similarly, suppose you can proactively communicate your user’s compliance issues with a transaction. In that case, you can keep them updated rather than frustrated and confused with their deposit or withdrawal status.

Crucially, it’s the difference between having a banking relationship built on sand; constantly at the risk of the whim of unpredictable events and at massive cost to your operational resources; and a banking relationship built on a bedrock of trust, achievable only through seamless automation with minimal manual interventions.

Redundancy without complication

Unlike more established industries, the relationship between banks and crypto platforms – including the most highly regarded ones! – is inherently tenuous. As a safeguard against unpredictable events, up to and including debankings, exchanges all prepare with redundancy: multiple banks are integrated to avoid the risk of dependency. But there’s a difference between strategic redundancy and over-complicating your operations.

For example, if you opt for the DIY route, you’ll have to take on five banks! That’s five times the contracts, five times the compliance checks, five times the resources needed to keep the relationship sweet…five times everything! It doesn’t matter how good your fiat car or drivers are; in this scenario, it’s bound to become unreliable. BaaS isn’t much better. For one, you’re still spinning multiple plates to an extent: multiple BaaS logins, multiple compliance interfaces, and more! In either instance, you’ve taken redundancy as a defense strategy and transformed it into the center of your operational systems!

TL;DR

A fiat strategy car race is much more than you might have expected. Crucial factors include:

– Its out-of-box 0-60 acceleration

– Its consistent top speed across markets

– Its impact on every function of your business

– Its roadworthiness from the bank’s perspective

– Its ability to handle redundancy without itself becoming redundant

You must use these components to judge the right fiat car for endurance.

Is that all? Of course not! Luckily, we’ve got you covered, and you can continue this journey in our Fiat Strategy Ebook here. We detail every single aspect of the Fiat Strategy race, big and small: from the overall impact of winning the competition to the detailed specifics of optimizing every business function with the right car!